Time series

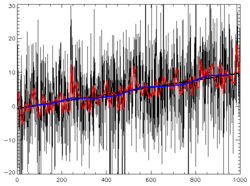

In statistics, signal processing and mathematical finance, a time series is a sequence of data points, measured typically at successive times spaced at uniform time intervals. Examples of time series are the daily closing value of the Dow Jones index or the annual flow volume of the Nile River at Aswan. Time series analysis comprises methods for analyzing time series data in order to extract meaningful statistics and other characteristics of the data. Time series forecasting is the use of a model to forecast future events based on known past events: to predict data points before they are measured. An example of time series forecasting in econometrics is predicting the opening price of a stock based on its past performance.

Time series data have a natural temporal ordering. This makes time series analysis distinct from other common data analysis problems, in which there is no natural ordering of the observations (e.g. explaining people's wages by reference to their education level, where the individuals' data could be entered in any order). Time series analysis is also distinct from spatial data analysis where the observations typically relate to geographical locations (e.g. accounting for house prices by the location as well as the intrinsic characteristics of the houses). A time series model will generally reflect the fact that observations close together in time will be more closely related than observations further apart. In addition, time series models will often make use of the natural one-way ordering of time so that values for a given period will be expressed as deriving in some way from past values, rather than from future values (see time reversibility.)

Methods for time series analyses may be divided into two classes: frequency-domain methods and time-domain methods. The former include spectral analysis and recently wavelet analysis; the latter include auto-correlation and cross-correlation analysis.

Contents |

Analysis

There are several types of data analysis available for time series which are appropriate for different purposes.

General exploration

- Graphical examination of data series

- Autocorrelation analysis to examine serial dependence

- Spectral analysis to examine cyclic behaviour which need not be related to seasonality. For example, sun spot activity varies over 11 year cycles.[1][2] Other common examples include celestial phenomena, weather patterns, commodity prices, and economic activity.

Description

- Separation into components representing trend, seasonality, slow and fast variation, cyclical irregular: see decomposition of time series

- Simple properties of marginal distributions

Prediction and forecasting

- Fully-formed statistical models for stochastic simulation purposes, so as to generate alternative versions of the time series, representing what might happen over non-specific time-periods in the future (prediction).

- Simple or fully-formed statistical models to describe the likely outcome of the time series in the immediate future, given knowledge of the most recent outcomes (forecasting).

Models

Models for time series data can have many forms and represent different stochastic processes. When modeling variations in the level of a process, three broad classes of practical importance are the autoregressive (AR) models, the integrated (I) models, and the moving average (MA) models. These three classes depend linearly[3] on previous data points. Combinations of these ideas produce autoregressive moving average (ARMA) and autoregressive integrated moving average (ARIMA) models. The autoregressive fractionally integrated moving average (ARFIMA) model generalizes the former three. Extensions of these classes to deal with vector-valued data are available under the heading of multivariate time-series models and sometimes the preceding acronyms are extended by including an initial "V" for "vector". An additional set of extensions of these models is available for use where the observed time-series is driven by some "forcing" time-series (which may not have a causal effect on the observed series): the distinction from the multivariate case is that the forcing series may be deterministic or under the experimenter's control. For these models, the acronyms are extended with a final "X" for "exogenous".

Non-linear dependence of the level of a series on previous data points is of interest, partly because of the possibility of producing a chaotic time series. However, more importantly, empirical investigations can indicate the advantage of using predictions derived from non-linear models, over those from linear models.

Among other types of non-linear time series models, there are models to represent the changes of variance along time (heteroskedasticity). These models are called autoregressive conditional heteroskedasticity (ARCH) and the collection comprises a wide variety of representation (GARCH, TARCH, EGARCH, FIGARCH, CGARCH, etc). Here changes in variability are related to, or predicted by, recent past values of the observed series. This is in contrast to other possible representations of locally-varying variability, where the variability might be modelled as being driven by a separate time-varying process, as in a doubly stochastic model.

In recent work on model-free analyses, wavelet transform based methods (for example locally stationary wavelets and wavelet decomposed neural networks) have gained favor. Multiscale (often referred to as multiresolution) techniques decompose a given time series, attempting to illustrate time dependence at multiple scales.

Notation

A number of different notations are in use for time-series analysis:

- X = {X1, X2, ...}

is a common notation which specifies a time series X which is indexed by the natural numbers. Another common notation is:

- Y = {Yt: t ∈ T}.

Conditions

There are two sets of conditions under which much of the theory is built:

- Stationary process

- Ergodicity

However, ideas of stationarity must be expanded to consider two important ideas: strict stationarity and second-order stationarity. Both models and applications can be developed under each of these conditions, although the models in the latter case might be considered as only partly specified.

In addition, time-series analysis can be applied where the series are seasonally stationary and non-stationary.

Models

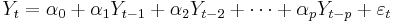

The general representation of an autoregressive model, well-known as AR(p), is

where the term εt is the source of randomness and is called white noise. It is assumed to have the following characteristics:

1. ![E[\varepsilon_t]=0 \,](/2010-wikipedia_en_wp1-0.8_orig_2010-12/I/746759e22cdd43d8ef30ef1cbea2d45a.png)

2. ![E[\varepsilon^2_t]=\sigma^2 \,](/2010-wikipedia_en_wp1-0.8_orig_2010-12/I/a9b969f5ec2694f562b555a8f80d5414.png)

3. ![E[\varepsilon_t\varepsilon_s]=0 \quad\forall t\not=s \,](/2010-wikipedia_en_wp1-0.8_orig_2010-12/I/f5e7131afa6be2c7bb7b95ab326ad960.png)

With these assumptions, the process is specified up to second-order moments and, subject to conditions on the coefficients, may be second-order stationary.

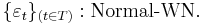

If the noise also has a normal distribution, it is called normal white noise (denoted here by Normal-WN):

In this case the AR process may be strictly stationary, again subject to conditions on the coefficients.

Related tools

Tools for investigating time-series data include:

- Consideration of the autocorrelation function and the spectral density function (also cross-correlation functions and cross-spectral density functions)

- Performing a Fourier transform to investigate the series in the frequency domain.

- Use of a filter to remove unwanted noise.

- Principal components analysis (or empirical orthogonal function analysis)

- Singular spectrum analysis

- Artificial neural networks

- time-frequency analysis techniques:

- Fast Fourier Transform

- Continuous wavelet transform

- Short-time Fourier transform

- Chirplet transform

- Fractional Fourier transform

- Chaotic analysis

- Correlation dimension

- Recurrence plots

- Recurrence quantification analysis

- Lyapunov exponents

See also

- Analysis of rhythmic variance

- Anomaly time series

- Autocorrelation

- Partial autocorrelation

- Lag operator

- Linear prediction

- Longitudinal study

- Model (macroeconomics)

- Moving average

- Nonlinear autoregressive exogenous model

- Prediction interval

- Seasonal adjustment

- System identification

- Time series database

- Trend estimation

- Dimension reduction

- Stream processing

References

Further reading

- Bloomfield, P. (1976). Fourier analysis of time series: An introduction. New York: Wiley.

- Box, George; Jenkins, Gwilym (1976), Time series analysis: forecasting and control, rev. ed., Oakland, California: Holden-Day

- Brillinger, D. R. (1975). Time series: Data analysis and theory. New York: Holt, Rinehart. & Winston.

- Brigham, E. O. (1974). The fast Fourier transform. Englewood Cliffs, NJ: Prentice-Hall.

- Elliott, D. F., & Rao, K. R. (1982). Fast transforms: Algorithms, analyses, applications. New York: Academic Press.

- Gershenfeld, Neil (2000), The nature of mathematical modeling, Cambridge: Cambridge Univ. Press, ISBN 978-0521570954, OCLC 174825352

- Jenkins, G. M., & Watts, D. G. (1968). Spectral analysis and its applications. San Francisco: Holden-Day.

- Priestley, M. B. (1981). Spectral analysis and time series. New York: Academic Press.

- Shasha, D. (2004), High Performance Discovery in Time Series, Berlin: Springer, ISBN 0387008578

- Shumway, R. H. (1988). Applied statistical time series analysis. Englewood Cliffs, NJ: Prentice Hall.

- Wei, W. W. (1989). Time series analysis: Univariate and multivariate methods. New York: Addison-Wesley.

External links

- A First Course on Time Series Analysis - an open source book on time series analysis with SAS

- Introduction to Time series Analysis (Engineering Statistics Handbook) - A practical guide to Time series analysis

- List of Free Software for Time Series Analysis

- Online Tutorial 'Recurrence Plot' (Flash animation); lots of examples

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||